The Gambia Introduces New Three-Year Tobacco Taxation Policy

BANJUL, 27 March 2017 : The Ministry of Finance and Economic Affairs of the Government of the Republic of the Gambia has introduced a new three-year tobacco taxation policy, 2017-2019, following discussions with and capacity building from the World Health Organization (WHO).

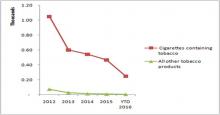

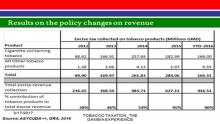

It will be recalled that the three levels of the World Health Organization (WCO-Gambia, AFRO and HQ) had, since 2012, been engaging and building capacity of the Ministry of Finance and Economic Affairs (MOFEA) and the Gambia Revenue Authority (GRA) to review the old tobacco taxation policy based on “volumes” and institute a new policy based on the number of “sticks”. After successfully implementing the maiden policy in 2013-2015, which had substantially increased revenue for Government and also reduced the level of tobacco import as described in the tables and graphs below, MOFEA and GRA, through the support of WHO, have taken another giant step to re-introduce the policy for the period 2017-2019.

Experience from the first phase of this initiative is widely acknowledged as one of WHO’s success stories, which has been shared with different countries in and outside the African Region. Under the new three-year policy, the National Authorities have agreed to raise tobacco tax as follows:

Under the new three-year policy, the National Authorities have agreed to raise tobacco tax as follows:

- increase the specific excise tax on cigarettes from D15/pack in 2016, to D20/pack in 2017

- increase the environmental tax on cigarettes from D2.42/pack in 2016 to D2.66/pack in 2017

- increase the excise tax on other tobacco products from D300/kg in 2016 to D330/kg in 2017, and

- increase the environmental tax on other tobacco products from D120/kg in 2016 to D165/kg in 2017

This policy measure is also expected to further increase revenue for Government and reduce tobacco import in the coming years.